9 Habits to Building Wealth & Be Wealthy from Salary

🌟 1. The Late-Night Truth About Money One day I was sitting alone & silence gave me space to think. “Am I building wealth, or just earning well?” That question hit me like a truck. You see, I’ve coached working professionals who earn 10-15 lakhs a year. But the shocking part? They’re still financially stressed. Credit card bills. EMIs. No savings. And I’ve also met quiet heroes earning ₹30,000 a month who are investing, saving, and steadily building wealth. That’s when it became crystal clear: Wealth isn’t about how much you earn. It’s about what you do with what you earn. 💡 2. The Great Income Illusion We’re conditioned to believe: “A bigger salary means a richer life.” But here’s what really happens: You get a raise. You buy a new car. You switch from Amazon Basics to Apple gadgets. Your rent doubles. Dining out triples. Welcome to lifestyle inflation — the sneaky villain of middle-class dreams. More income. More expenses. Same financial stress. “You’re not broke. You’re just budgeting wrong.” Let that sit. 🤿 3. Why Discipline > Income Let’s imagine wealth as a water tank. Your salary is the water coming in. Your spending habits? The holes at the bottom. You could have the biggest pipe in the colony, but if the holes are bigger, you’ll never store a drop. Discipline is about fixing the holes. Not to live a dry life. But to make sure the water you earn… stays. 📅 4. The 9 Habits That Build Real Wealth Here are 9 habits that have helped my clients (and myself) turn their income into actual, peaceful wealth. ✅ Habit #1: Live Below Your Means No, not miserably. Just mindfully. It’s not about saying no to coffee. It’s about saying YES to future peace. Drive a car you can comfortably afford. Rent a house that lets you sleep without EMI nightmares. Create a surplus. That’s your seed for wealth. ✅ Habit #2: Save Consistently (Even ₹500!) If you can save ₹500/month, you can save ₹5000/month. It’s a muscle. Automate it. Set up an auto-debit the day your salary hits. Pay yourself first. Because if you wait till the month ends… well, you know how that story goes. ✅ Habit #3: Invest Early, Invest Monthly SIPs are not just for finance geeks. They’re for everyday warriors like us. Don’t wait for lakhs. Start with hundreds. Let time and compounding do their job. ✅ Habit #4: Avoid Bad Debt Not all loans are evil. But EMIs for gadgets, vacations, and fancy phones? That’s a trap. You don’t buy the thing. You rent peace to own it. Use credit wisely. Or it will use you. ✅ Habit #5: Track Every Rupee If I gave you ₹1 lakh cash today, would you know where it went in 30 days? Track your expenses. Use a journal. App. Whiteboard. Anything. But know. Clarity is freedom. ✅ Habit #6: Build an Emergency Fund Life throws curveballs. Job loss. Medical bills. Car repairs. An emergency fund (3-6 months of expenses) is your seatbelt. You’ll be glad you had it before the accident. ✅ Habit #7: Know Needs vs. Wants That new phone? Want. Groceries? Need. Most broke people confuse the two. Wealthy people delay the want, never compromise the need. Learn the difference. Live the difference. ✅ Habit #8: Think Long Term Next month’s salary won’t retire you. But 10 years of SIPs will. Plan for your future self. He’ll thank you with a smile, a paid-off house, and peaceful vacations. ✅ Habit #9: Learn Before You Spend Got tempted to buy something? Pause. Ask: “What will this cost me over 5 years?” Learn about where your money goes. Be curious. Read. Ask. Explore. “Financial literacy is self-respect in action.” 🌿 5. Wealth Is Not Luck. It’s Layers of Intentionality You don’t need to be born rich. Or win a lottery. You just need to: Live a little below your means Save a little more than you want to Invest a little earlier than you think And learn a little every single week That’s it. Repeat that for a decade. And you’ll be shocked at what you built. 📍 6. Closing Cue: Ask Yourself This Tonight Before you sleep tonight, ask: “Am I earning to look rich, or building to be free?” If the answer makes you uncomfortable, that’s your first breakthrough. Start small. Start today. Because peace of mind isn’t a product. It’s a habit. And you’re just 1 habit away from wealth. Warmly, Shiv Dwivedi Your Wealth Coach & Financial Freedom Friend

💡Corporate Health Insurance vs. Personal Cover: Do You Really Need Both?

☕ 1. The Late-Night Call That Woke Me Up It was 1:43 AM. My phone buzzed. It was Ravi, an old coaching client and a dear friend. “Shiv bhai… my mom’s in the hospital. Insurance rejected some charges. I thought my company plan would handle everything…” His voice was shaking—not because of the money—but because of the uncertainty. That helpless feeling when something should have worked… but didn’t. We got things sorted. But that night taught both of us something many professionals learn too late: “Just because you have corporate health insurance doesn’t mean you’re fully protected.” Have you assumed that too? 🔍 2. The Illusion of Safety: Why Corporate Cover Feels Enough If you’re a salaried professional, your company probably gives you health insurance. Sounds great, right? You might even think: “It’s already covered.” “Why pay extra?” “I’m young and healthy anyway.” But let’s look deeper. Corporate health insurance is like a raincoat. It works—until the storm turns into a cyclone. And by then, you’re already drenched. 🧳 3. Let’s Talk Metaphor: Travel Insurance at the Airport Imagine you’re going on an international trip. Your airline gives you basic travel insurance—lost luggage, minor delays. But what if: Have you fallen seriously ill abroad? Need hospitalization? Miss 3 connecting flights? That basic plan? Won’t help much. Corporate health cover is like that.It’s helpful, but it’s not built for everything. And worst of all? You don’t control it. Your employer does. 🧠 4. Reflect With Me: Who’s Actually in Control? Here’s a quick reality check: What happens to your cover if you switch jobs? Or worse, if you’re laid off or retire? Will your corporate plan support your parents or dependents fully? Most won’t. Or if they do—it’s limited. Often ₹2-5 lakhs max. So let’s ask the real question: “If a major medical emergency strikes after your job ends, do you have a Plan B?” If your answer makes you pause, good. That pause is awareness. 📉 5. Real Life: When Corporate Cover Wasn’t Enough Let me share a story. Anita, a 38-year-old marketing manager, had ₹3L corporate insurance. Her dad suffered a heart attack. The hospital bill? ₹5.2 lakhs. Her plan covered ₹3L. She borrowed the rest. After that, she decided to buy a personal health cover—just ₹12,000 a year. Small price, big relief. Two years later, she needed surgery herself. This time, she didn’t panic. The policy took care of it. She told me, “Shiv, I sleep better now. I’m not depending on my HR anymore.” That’s peace. That’s planning. That’s power. 📊 6. Quick Comparison: Corporate vs. Personal Health Cover Criteria Corporate Cover Personal Health Insurance Control Employer-controlled You decide everything Coverage Amount Usually low (₹2–5L) Can go up to ₹25L+ Portability Ends with job Fully portable Family Inclusion Often limited You can cover spouse, kids, parents Claim Process Employer-dependent You deal directly with insurer 💬 7. But Shiv, Won’t I Be “Double Covered”? Good question. No. This works to your advantage. In insurance terms, this is called “top-up” or “backup” coverage. Here’s how it works: You use your corporate cover first. If expenses go beyond, your cover takes over. It’s like having Plan A and Plan B—in a world where Plan A often fails silently. 📈 8. Rising Medical Costs — Are You Prepared? Let’s talk numbers: A single hospitalization in a metro hospital can cost ₹5–10L+ A cancer treatment plan can run into ₹25–40L+ A heart surgery costs ₹3–6L+ Daily ICU costs: ₹30,000–₹50,000 in private hospitals Corporate plans often don’t cover: Pre/post-hospitalization Room upgrade charges Experimental procedures OPD, maternity, mental wellness (in many cases) In short, they’re just not enough anymore. 🤝 9. So, What Should You Do as a Professional? Here’s a simple plan: ✅ 1. Keep Your Corporate Cover. It’s useful. No need to cancel it. ✅ 2. Buy a Personal Health Cover. Start with ₹10–₹15 lakhs. Add a top-up if needed.Even ₹10,000–₹15,000/year premiums are worth it. ✅ 3. Include Your Family. Get spouse, kids, and especially aging parents covered. ✅ 4. Buy Early. The younger you are, the cheaper and smoother the process is. ✅ 5. Review Yearly. Add riders. Update the sum assured as income grows. You insure your car. You insure your phone. Why not insure your peace of mind? 🧘 10. Closing Reflection: Health is Wealth. But What About Healthcare? We often say, “Health is Wealth.” But in today’s world, healthcare is expensive.And hoping your HR policy will shield you forever is like expecting your umbrella to withstand a hurricane. Think about it: “If something happened today… are you prepared, or are you just depending on your company?” Your answer could change your family’s future. ❤️ From Shiv’s Heart: Health insurance isn’t about being afraid. It’s about being free. Free from uncertainty.Free from regret.Free to focus on healing, not hustling to arrange funds. Invest in a personal health cover—not just because you can afford it…But because your peace is priceless.

How to Break Free from EMI-to-EMI Living

☕ 1. The Monthly Date I Dreaded It was the 5th of the month. Again. My phone buzzed with the usual barrage of debit messages. “₹12,343 debited — Home Loan EMI.”“₹5,219 debited — Car Loan EMI.”“₹2,750 debited — Phone EMI.”“₹3,499 debited — Personal Loan EMI.” Sigh. I remember staring at my coffee like it would somehow cancel the next notification. “Is this what adulting is all about? Earning to just repay?” I chuckled, but not the happy kind. The chuckle you let out when you feel trapped, but you don’t want to admit it. Ever felt that way, too? 🧳 2. Life in Monthly Installments Imagine life as a suitcase. You’re trying to pack in peace, purpose, health, family time, dreams, joy. But each EMI is like a heavy stone someone keeps throwing in. TV EMI. Sofa EMI. Kitchen EMI.By the time you want to put in something meaningful—there’s no space left. That’s EMI-to-EMI living.You’re not living for yourself—you’re living for your EMIs. It’s not that loans are evil. No. But unchecked EMIs become silent handcuffs. Have you ever looked at your salary credit and felt it vanish before you could even plan what to do with it? 💭 3. The Inner Whisper We All Ignore I remember one evening, my daughter asked,“Papa, can we go for ice cream tomorrow evening?” And I responded with my go-to line: “Let’s see beta, papa has work.” But inside, I was thinking: “I don’t even know if I’ll have the money left by then.” That thought broke me. Not because of the ice cream. But because I wasn’t free. I was earning well, but I didn’t feel rich. I felt restricted. Choked. Like I was running but not reaching. That was my wake-up call. 🔄 4. Why Most of Us Fall Into the EMI Trap Let’s be honest. It doesn’t start as a trap. It starts innocently—”Why pay ₹60,000 upfront when I can pay just ₹2,000 a month?”“EMIs make it affordable,” we say. But then comes the next one. And the next. Before you realize, you’re juggling five balls in the air, hoping none fall. The illusion of affordability slowly becomes the reality of anxiety. It’s like borrowing tomorrow’s peace to fund today’s excitement. And soon, we forget what peace even felt like. 🪞 5. Reflection Time: Where Are You Right Now? Let’s pause. Grab a pen or just close your eyes and think: These are not financial questions. They’re freedom questions. 🧠 6. Breaking Free: The Mindset Shift Here’s what I learned the hard way: The first step to breaking free is not paying off the EMI. It’s understanding why you took it in the first place. Ask yourself: Once you shift from emotion-driven expenses to value-driven choices, you start taking your power back. 🔧 7. The System I Followed to Set Myself Free Let me share the exact 5-step system I used—simple, human, and practical: ✅ Step 1: List all EMIs with interest rates and tenure Most people fear this step. But clarity brings power. ✅ Step 2: Prioritize High-Interest EMIs Personal loans, credit cards—they bleed the most. Tackle them first. ✅ Step 3: Create a “Freedom Fund” A separate savings account just for closing EMIs early. Automate a fixed amount monthly. ✅ Step 4: Consolidate Wisely If you have too many, consider one lower-interest loan to close the rest. But only if you close, not add more. ✅ Step 5: Say No (Even When It’s Hard) Learn to say: “Not now.” A ₹60,000 phone won’t feel good if it brings ₹1,500 stress for the next 12 months. Every EMI you say no to is a “yes” to your future peace. 💡 8. The “Freedom Visualization” That Helped Me Close your eyes for 10 seconds. Visualize a month where: That vision? That’s your why. And it’s more powerful than any budgeting app. 💬 9. A Conversation With My Future Self This might sound funny, but I once wrote a letter to my future self. It read: “Hey, Shiv. If you’re reading this, I hope you said no to that third credit card. I hope you chose freedom over impressing the neighbors. I hope you built wealth that gave you peace. And I hope you remembered: Money is a tool, not a trap.” That letter still sits in my journal. What would your letter say? 👨👩👧 10. One Client’s Journey (That’ll Stay With Me Forever) Poonam, a 33-year-old working mom from Delhi, came to me last year, exhausted. She said, “Shiv, I earn ₹85K/month but have nothing left by the 10th.” We unpacked her EMIs—6 of them. And just like me, she felt “normal” because “everyone has them.” But normal was costing her peace. We worked together: 6 months later, she sent me a message: “I just paid off my personal loan early. I feel like I can breathe again.” That’s real wealth, my friend. 🔁 11. Breaking the Cycle Is Not About Sacrifice. It’s About Choice. People often think: “If I stop EMIs, I’ll have to give up my lifestyle.” No. You’re not giving up your lifestyle.You’re choosing a life with style—peace, dignity, clarity. Wouldn’t you rather wait 6 months for something you can buy in full, than spend 12 months being stressed about something you bought in a rush? 🔚 12. Closing Insight: Real Riches = Emotional Freedom Let’s be real. What you want is not just a zero on the credit card. You want to feel safe. Empowered. Calm. Able to look at your child, your partner, or even your mirror and say: “I’m not surviving anymore. I’m building. I’m choosing.” Money is powerful. But clarity is power.And peace of mind is the real ROI. 💬 Final Reflective Cue: Grab a cup of chai tonight. Sit with yourself and ask:“Which EMI is costing me more than money?” And when you get that answer, promise yourself:“I will start walking out of this loop—step by step, month by month.” You don’t need to do it overnight. But you do need

The 1% Money Habits That Wealthy Never Ignore

Ah, retirement. The very word conjures images of endless sunny days and newfound freedom. But for many, the path to this idyllic future is shrouded in misconceptions, leading to procrastination and regret. Are you telling yourself, “I’ll start saving next year,” or “My pension will take care of everything”? These common myths can derail your dreams. Discover the unshakeable truths about retirement planning, the power of compounding, and the essential investment vehicles that can help you design your freedom years. Your future self will thank you for the choices you make today. Start sketching your masterpiece now!

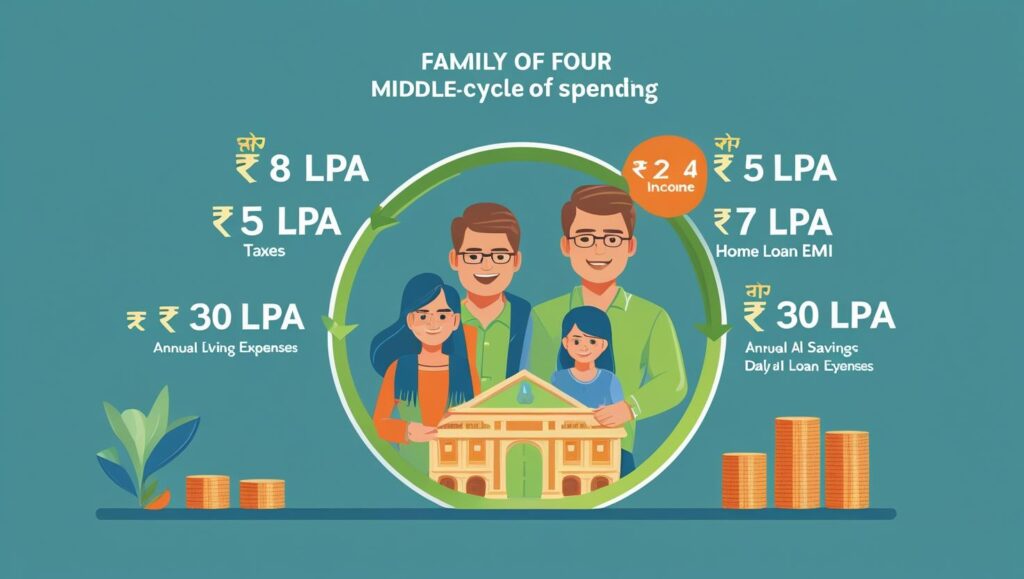

Smart Money Management: How to Escape the Middle-Class Trap and Build Lasting Wealth

A personal budget is a structured financial plan designed to track your income and expenses over a specific period, typically monthly or weekly.

Beyond the Beach: Debunking Retirement Myths and Designing Your Freedom Years

A personal budget is a structured financial plan designed to track your income and expenses over a specific period, typically monthly or weekly.

Good Debt vs. Bad Debt: A Guide to Smart Borrowing

A personal budget is a structured financial plan designed to track your income and expenses over a specific period, typically monthly or weekly.

Why Financial Planning Should Be First Career Skill?

Financial planning isn’t just about numbers; it’s about creating a life of freedom, security, and fulfillment. By making it your first career skill, you lay the groundwork for achieving your dreams without stress or compromise.

Remember, it’s not about how much you earn but how effectively you manage and grow your earnings. Start your journey today, and watch as the discipline of financial planning transforms not just your bank account but your entire life.

5-common-financial-mistakes-and-how-to-avoid-them

True financial success lies in a goal-based investing approach, which aligns your investments with your unique financial objectives.

how-to-plan-your-investments-for-financial-success?

A personal budget is a structured financial plan designed to track your income and expenses over a specific period, typically monthly or weekly.