The 1% Money Habits That Wealthy Never Ignore

Ah, retirement. The very word conjures images of endless sunny days and newfound freedom. But for many, the path to this idyllic future is shrouded in misconceptions, leading to procrastination and regret. Are you telling yourself, “I’ll start saving next year,” or “My pension will take care of everything”? These common myths can derail your dreams. Discover the unshakeable truths about retirement planning, the power of compounding, and the essential investment vehicles that can help you design your freedom years. Your future self will thank you for the choices you make today. Start sketching your masterpiece now!

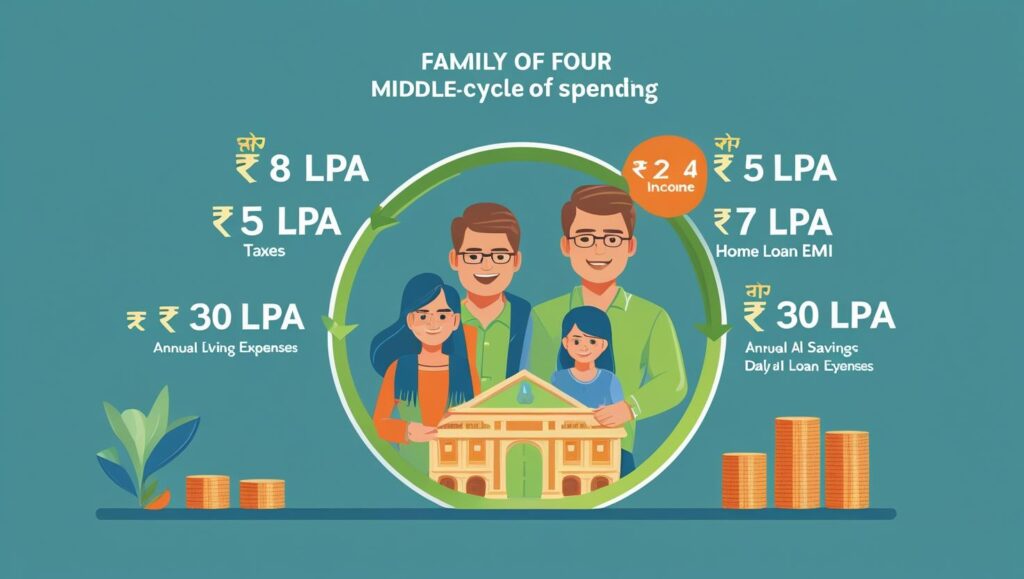

Smart Money Management: How to Escape the Middle-Class Trap and Build Lasting Wealth

A personal budget is a structured financial plan designed to track your income and expenses over a specific period, typically monthly or weekly.

Beyond the Beach: Debunking Retirement Myths and Designing Your Freedom Years

A personal budget is a structured financial plan designed to track your income and expenses over a specific period, typically monthly or weekly.

Good Debt vs. Bad Debt: A Guide to Smart Borrowing

A personal budget is a structured financial plan designed to track your income and expenses over a specific period, typically monthly or weekly.

Why Financial Planning Should Be First Career Skill?

Financial planning isn’t just about numbers; it’s about creating a life of freedom, security, and fulfillment. By making it your first career skill, you lay the groundwork for achieving your dreams without stress or compromise.

Remember, it’s not about how much you earn but how effectively you manage and grow your earnings. Start your journey today, and watch as the discipline of financial planning transforms not just your bank account but your entire life.

5-common-financial-mistakes-and-how-to-avoid-them

True financial success lies in a goal-based investing approach, which aligns your investments with your unique financial objectives.

how-to-plan-your-investments-for-financial-success?

A personal budget is a structured financial plan designed to track your income and expenses over a specific period, typically monthly or weekly.

Why Goal-Based Investing is the Key to Financial Success?

True financial success lies in a goal-based investing approach, which aligns your investments with your unique financial objectives.

A Simple 6-Step Guide to Creating a Personal Budget

A personal budget is a structured financial plan designed to track your income and expenses over a specific period, typically monthly or weekly.

How to choose right Mutual Funds?

Mutual funds have long been a favored choice for those seeking to build wealth, offering a professionally managed investment that can cater to a wide range of financial goals.